When the budget presentation is made to Council, information is given about how Georgina's tax rate compares to other municipalities in the Region. While Georgina appears to have the highest tax rate of the municipalities in York Region, when other factors are considered this is not the case.

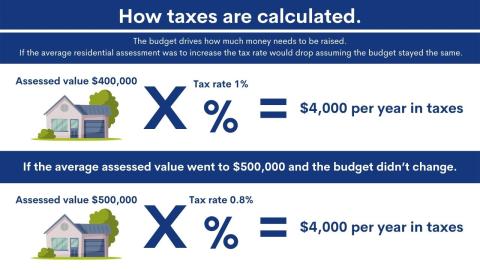

There are two main things that are looked at in the property tax calculation, the total operating expenditures for the year so the Town can provide services to its residents and the total current market value of the assessment base over which the operating expenditure is recovered.

How is the tax rate calculated?

The tax rate is calculated by dividing the budgeted operating expenditures by the total assessed value.

When you are comparing Georgina to other municipalities in the Region, it is important to remember two things that affect our tax rate. The cost of things such as gas, repairs, equipment and vehicles to provide services is similar across the Region. There is a large difference in the current market value of properties in Georgina compared to the rest of York Region. This is the main reason for the difference in the tax rate.

More information

If you have any questions about comparable tax levels or rates in Georgina, please contact the Tax and Revenue Division by email at revenue@georgina.ca.

Direct any questions about the calculation of assessment values to MPAC (Municipal Property Assessment Corporation).