Property taxes

The Town of Georgina issues tax bills that cover Town services and programs, education purposes and levies for York Region.

- Learn how to pay your property taxes

- View your tax balances

- Review your property assessment

- Learn about Tax Rebate and Incentive Programs

Billing

Due dates

The property tax due dates will change each year. You can find the due date on your property tax bill. The interim property tax instalments are due Feb. 27 and April 27, 2026.

Lost tax bill

Failure to receive your property tax bill does not mean you do not have to pay. You are responsible for any amounts that come due and any penalty and interest charged on these amounts. View your tax balances through our online portal.

Late payment penalty charge

Penalty is charged at the rate of 1 per cent on instalment amounts that are not paid by the due date. This penalty is added on the first day of default. Section 345(2) of the Municipal Act, 2001 provides authority to add penalty.

Interest charges

On the first day of each month, the outstanding balances are charged interest. Until the balance is paid in full, outstanding balances continue to be charged on outstanding balances. The interest rate for previous years’ taxes outstanding is 1.25 per cent and the rate for current year taxes is 1 per cent. Section 345(3) of the Municipal Act, 2001 provides authority to add interest.

Please note, once interest and penalty is charged to your account, it remains payable. Staff does not have the authority to reduce or remove these charges.

When you make a payment, any interest on the account is paid first and the remainder applied to the oldest tax outstanding.

Change my address

To notify us of any changes to your address, complete and submit the Change of Address Form.

Authorize a third party

If you would like to authorize someone who is not an owner on your property to have access to your tax and/or water account information, complete and submit the Authorization form.

Requesting a tax certificate

A tax certificate can be ordered by submitting your request in writing along with a cheque for $75 to the Tax and Revenue Division, located at 26557 Civic Centre Rd, Keswick ON L4P 3G1. If you would like the certificate emailed upon receipt, please provide an email in your request that the certificate can be mailed to, otherwise, the certificate will be sent through regular mail.

Please include:

- Property address/location

- Legal description

- Assessment roll number

If this request is in regard to a property closing, please advise of the closing date.

Calculating property taxes

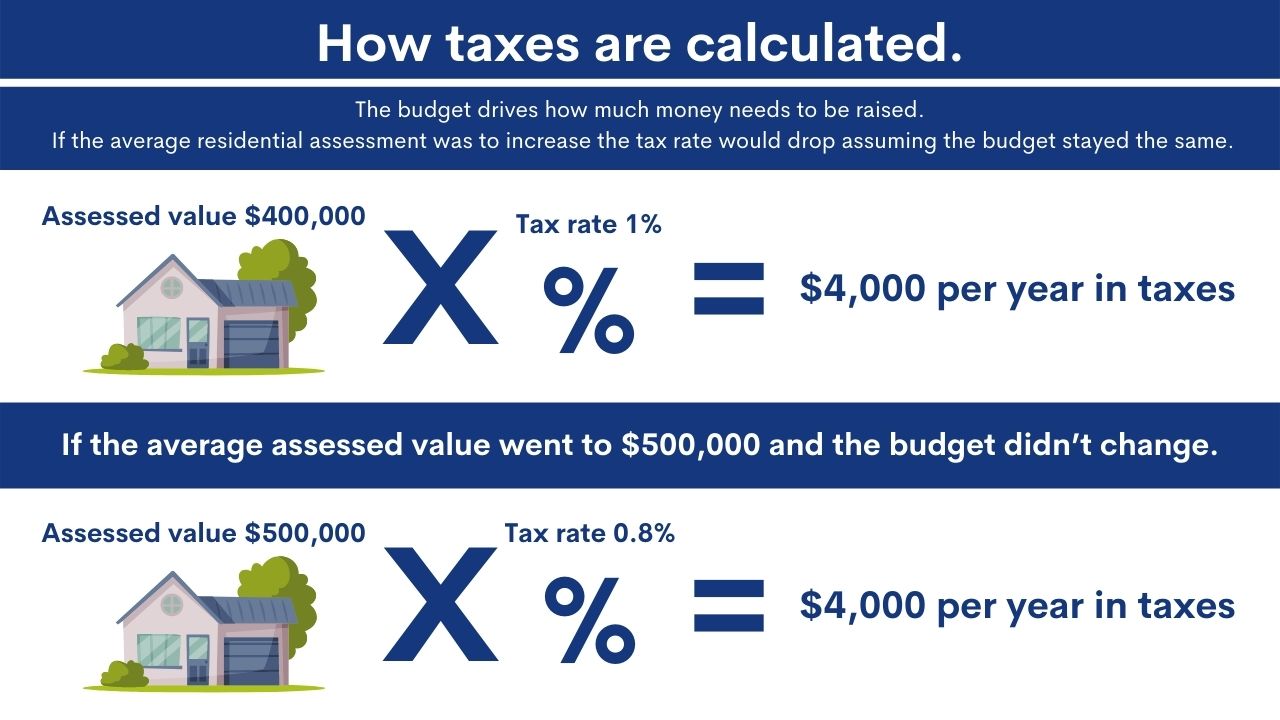

The Municipal Property Assessment Corporation (MPAC) sets the assessed values for all properties in Ontario. These assessed values are provided to the Town and are updated yearly. To calculate your property taxes, we multiply your assessed value by our tax rate.

More information

More information

To appeal your assessment or for additional information on property assessments, visit:

Municipal Property Assessment Corporation

MPAC Request for Reconsideration Forms

Additional MPAC videos on calculating assessment and property tax

Previous years brochures

2025 Interim Tax Brochure

2024 Final Tax Brochure

2024 Interim Tax Brochure

2023 Final Tax Brochure

2023 Interim Tax Brochures

2022 Final tax brochure

2022 Interim tax brochure

2021 Final tax brochure

2021 Interim Billing brochure

2020 Interim Tax Brochure

2019 Final Tax Brochure

2019 Interim Billing Brochure

Frequently asked questions

How many tax bills do I receive a year?

There are two tax bills produced each year. The first one, issued in January, is the interim tax bill and is 50 per cent of the taxes billed the previous year. The final tax bill is produced in June and any increase or decrease in current year assessment will be reflected on the final bill. Both the interim and final tax bill are comprised of two relatively equal installments.

How are taxes calculated?

Taxes are calculated by taking the assessed value of your house multiplied by the tax rate. The Municipal Property Assessment Corporation (MPAC) is responsible for assigning an assessed value which is unique to your property. The tax rate is the same for all similar-use properties. (For example, all residential properties would be multiplied by the same tax rate but would have a unique assessed value.)

How do I know if my house is assessed properly?

MPAC typically reassesses properties on a 4 year cycle, however due to the impacts of COVID-19 the last reassessment was not conducted. Properties are still being assessed using the same values that they were in 2020. As a general rule, if you can sell your property for more than your assessed value you have a fair assessment. For any questions about assessment, contact MPAC at 1-866-296-6722.

Why does my neighbour have a different assessment?

MPAC takes into account multiple factors when determining assessment for a property. These include recent sales, size and location of property, number of bedrooms, number of bathrooms and amenities such as pools or garages can all have an impact on the assessed value of the property.

Do all of the taxes collected go to Georgina?

No, Georgina is a lower-tier municipality which means a portion of property taxes goes to York Region. In addition, a portion of taxes is also sent to the school boards to fund the education system. For 2024, the Town of Georgina kept 53.8 per cent of taxes raised, while York Region collected 32.5 per cent and the school boards collected 13.7 per cent.