2026 Budget

Every year, the Town of Georgina passes a budget to determine how funds are allocated. The Town is committed to developing a responsible budget to ensure it balances the needs of a growing town while maintaining high quality municipal services. Property taxes go towards a variety of programs and services which families rely on and use every day – including road work, snow clearing, garbage collection, fire and rescue services, and recreation and culture programs.

On Dec. 2, 2025, Georgina Council adopted the 2026 budget, which includes a 2.25 per cent increase for operating expenditures and 1.25 per cent increase to the infrastructure levy, for a total tax levy increase of 3.5 per cent. To learn more, view the media release for the adoption of the 2026 Budget.

Contact us

Email any questions and feedback to budget@georgina.ca.

Budget approval process under Bill 3, Strong Mayors, Building Homes Act, 2022

Bill 3, Strong Mayors, Building Homes Act, 2022, received Royal Assent on Sept. 8, 2022, and was added to the Municipal Act as Part VI.1 – Special Powers and Duties of the Head of Council. On Aug. 21, 2023, the Ontario government announced it was extending strong mayor powers to 21 municipalities, including the Town of Georgina, that have projected to have populations of 50,000 or larger by 2031, and that have committed to meeting the assigned provincial housing targets. On Oct. 31, 2023, strong mayor powers were extended to the Town of Georgina.

The bill extends the mayors of the designated municipalities special powers and duties including, among others, the power to propose the municipality’s annual budget, subject to Council amendments, a mayoral veto, and a Council override process as defined under O. Reg. 530/22. These powers cannot be delegated.

Under Bill 3, Strong Mayors Act described below, the budget approval process under this framework is as follows:

- Council has 30 days to propose amendments to the Mayor’s proposed budget, and if no amendments are presented, the Mayor’s proposed budget is deemed to be adopted.

- The Mayor may veto Council amendments within 10 days after the time period for Council to pass amendments. If the Mayor does not exercise the veto power, the amended budget is deemed adopted.

- Council may override the veto with a two-thirds majority vote within 15 days after the time period for the Mayor to veto an amendment, in which case the amended budget is considered adopted.

- If Council does not override the Mayor’s veto, the proposed budget is considered adopted.

Frequently asked questions for the 2026 proposed budget

How much will my tax and water bills go up based on the proposed increases?

For households on water and wastewater services, the proposed increase at 9.3 per cent will result in a quarterly bill of approximately $350, based on the average usage of 41 cubic metres per quarter.

Why do we need a stormwater fee and how much can I expect to pay?

Stormwater fees are crucial because they provide a dedicated source of funding for maintaining and improving stormwater infrastructure. The 2026 stormwater rate is a 2 per cent increase over the 2025 rate, with the average bill at approximately $165 per year for the residential property class tax category (RT).

Is there a tax levy increase for the replacement Civic Centre in the 2026 budget?

There is no tax levy increase relating to the replacement Civic Centre in the 2026 budget. The funding for the construction of the replacement Civic Centre was established during the 2023 and 2024 budget process and there will be no additional tax levy increases required for this project.

Why has the Town hired so many new positions over the past five years?

Georgina is a growing municipality. New positions generally are a result of legislative, service level or growth-related impacts. More than 50 per cent of positions hired over the past five years are directly related to growth and were funded by growth-related revenues, such as assessment growth, with no tax levy increases.

Is the 1.25 per cent infrastructure levy in 2026 really necessary, or is it just building up large reserve funds?

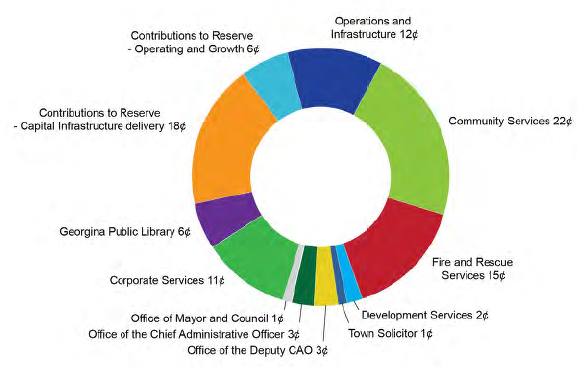

What does the municipal portion of my 2026 taxes pay for?

- $0.22 - Community Services

- $0.18 - Contribution to Reserve - Capital Infrastructure delivery

- $0.15 - Fire and Rescue Services

- $0.12 - Operations and Infrastructure

- $0.11 - Corporate Services

- $0.06 - Georgina Public Library

- $0.06 - Contributions to Reserve - Operating and Growth

- $0.03 - Office of the Deputy CAO

- $0.03 - Office of the CAO

- $0.02 - Development Services

- $0.01 - Town Solicitor

- $0.01 - Office of Mayor and Council

What makes up the budget?

A municipality’s budget is made up of:

- Operating budget covers the day-to-day expenses of running the municipality. The operating budget focuses on delivering the consistent, reliable services that residents and businesses expect. The financial decisions we make today are critical to the long-term sustainability of the Town.

- The Town’s capital budget covers large infrastructure and other long-term projects. The 10-year Capital Financial Plan is an updated financial plan to ensure the Town can fully fund its 10-year capital plan.

- Reserve funds act as a savings account, to set funds aside for cyclic costs like elections and for planned capital costs.

- There are other components that are included in the Town's budget, such as:

- Debt financing

- Assessment growth

- Development charges

Where does the Town get the money to pay for its ongoing wide range of services?

The Town of Georgina, like most Ontario municipalities, uses a variety of revenue and funding sources to pay for a wide range of services.

- Property taxes – Largest source of municipal revenue, this is calculated by applying the municipal tax rate by the property assessment as determined by MPAC.

- User fees – These fees are paid for by the specific user or group of users, including visitors and non-residents, rather than property owners through the municipal tax base.

- Water and wastewater rates – Water consumption and wastewater usage charges are based on how much water a property uses. Consumption is measured by the water meter.

- Stormwater rates – A reliable and sustainable approach to stormwater management. A charge levied on property owners to maintain stormwater infrastructure.

- Grants – Funding received by government grants to fund operating activities makes up only a small part of the municipal budget. It is important to ensure the municipality can operate on its own without reliance on other levels of government.

- Other – Miscellaneous revenues such as permits and licences.

Where do my taxes go?

Your property taxes are used to fund programs and services at the Town, regional and provincial level.

Town services

- Animal services

- Fire and rescue services

- Georgina Public Library

- Licences and permits

- Infrastructure replacement

- Maintenance of Town facilities

- Municipal law enforcement and by-laws

- Office support and administration

- Parks, sports field and beaches maintenance

- Recreation and culture services

- Roads services

- Snow removal on local roads and sidewalks

- Town planning and development

- Waste collection

Regional services

- Maintenance of main/major roads, sewers and bridges

- Public health services

- Regional planning and growth management

- Regional waste disposal

- Snow removal on regional roads

- Social assistance

- Social housing

- Traffic planning on regional roads

- York Regional Police

- York Region Transit and Viva services

Province of Ontario

- Education

What is the difference between assessed values and market values?

The assessed value of your house is calculated by MPAC and is based on numerous factors, including location, amenities available, lot size, house size, property sales and overall details of the house. This assessed value is then multiplied by the tax rate to arrive at the property taxes charged by the municipality.

The Market value is the price you would get for your property should you decide to sell; the market value will fluctuate throughout the year and is typically higher than your assessed value. A property's market value has no direct influence on the taxes of a property and is not a reliable method to calculate the taxes on a property.

How are property taxes calculated?

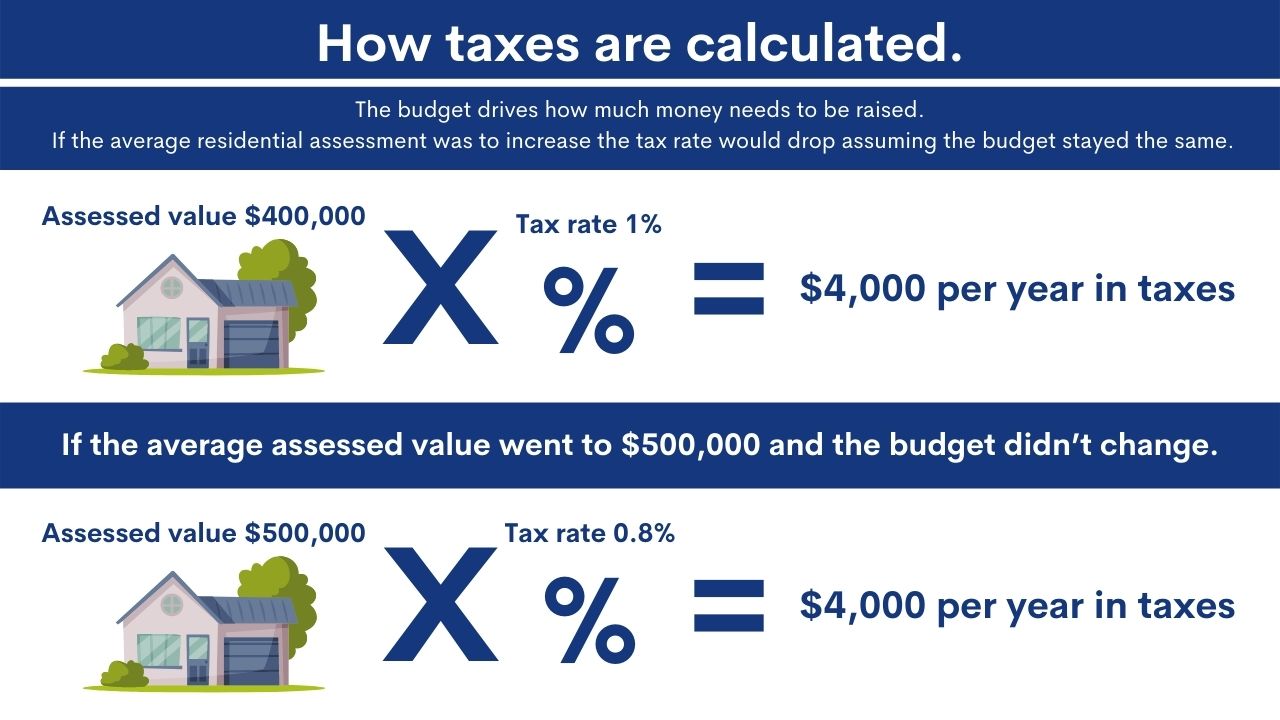

The Municipal Property Assessment Corporation (MPAC) sets the assessed values for all properties in Ontario. These assessed values are provided to the Town and are updated yearly. To calculate your property taxes, we multiply your assessed value by our tax rate.

For example:

MPAC typically reassesses property on a 4 year cycle, however due to the impacts of COVID-19 the last reassessment was not conducted. Properties are still being assessed using the same values that they were in 2020. If properties are reassessed at a higher value it does not necessarily mean that there will be an increase in taxes.

How does the budget impact property taxes?

The budget sets forth the amount of money each year that the municipality must raise in order to meet the objectives within the budget document. The main way of raising these funds is through the property tax levy. The Town of Georgina is a lower-tier municipality, meaning taxes paid for your Georgina property also go to York Region and the Province for the education levy. Approximately 54 per cent of taxes paid go to Georgina. Since Georgina is a lower tier, a budget increase from Georgina will only impact the Georgina portion of your bill.

How can I view the assessed value for my home?

Did you know that assessed values are public information? You can view the roll book located at the Civic Centre or you can view assessed values online at georgina.ca/TaxandWaterPortal.

What are assessment growth and development charge revenues?

Assessment growth refers to new taxes collected from newly constructed or expanded homes and businesses to fund the Town services they receive (operating budget costs). Development charges, on the other hand, are fees levied by the Town on new development projects – such as residential, commercial and industrial buildings – to help pay for the new infrastructure needed (capital budget costs). Development charges are typically paid by developers at the time of building permit issuance. The MURC is a prime example of “growth paying for growth,” as there was no tax levy impact for existing residents in terms of either operating or capital expenditures for this facility.

This was made possible through strategic financial planning and careful allocation of revenues from assessment growth and development charge collections.